Cincinnati Financial Stock Dividend

A stocks dividend uptrend rating is dependent on the companys price to earnings pe ratio to evaluate whether or not a stocks dividend is likely to trend upward.

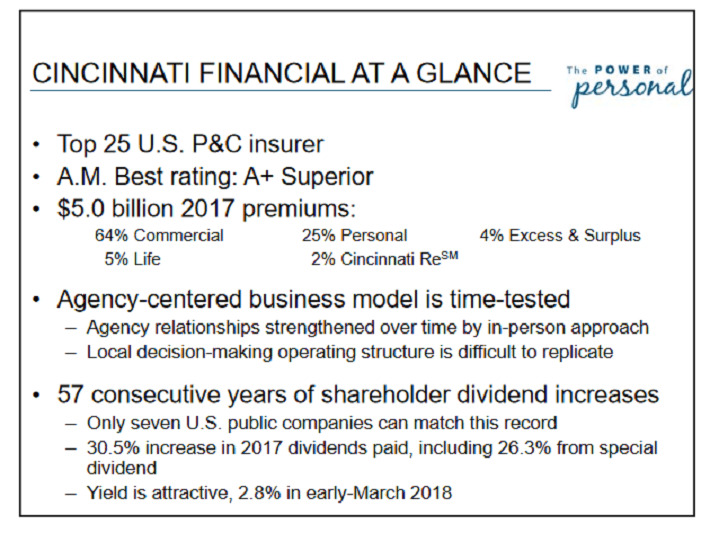

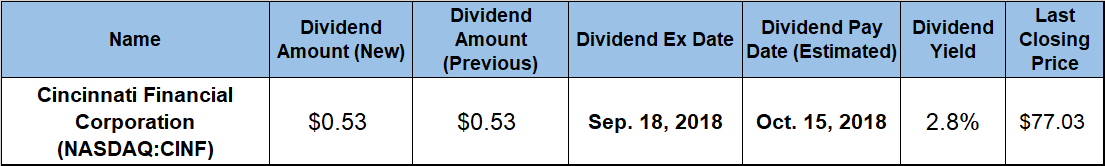

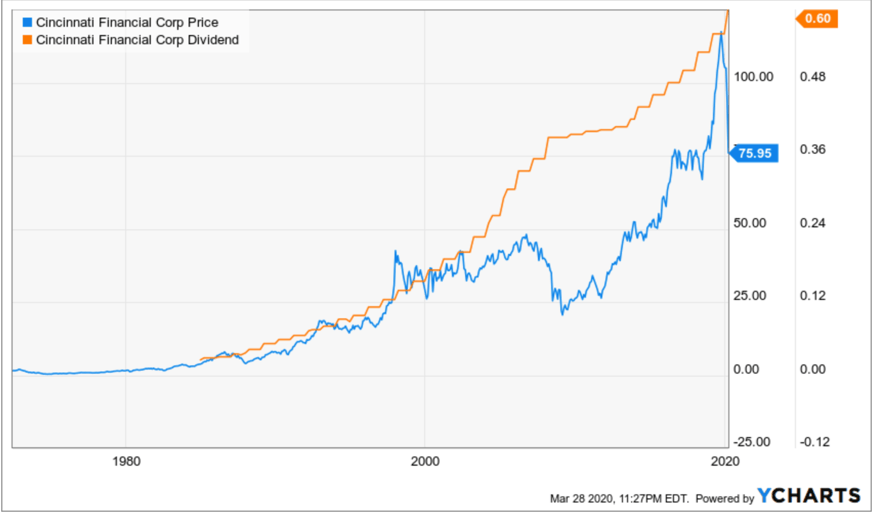

Cincinnati financial stock dividend. 240 dividend yield. By month or year. In december the company which was trading at about 105 per share at the time. Cincinnati financial pays an annual dividend of 240 per share with a dividend yield of 323.

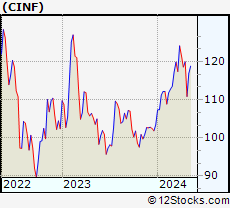

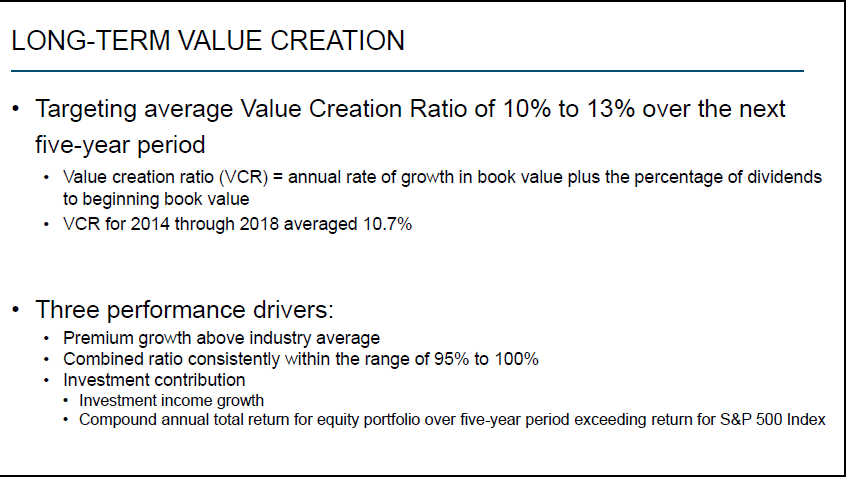

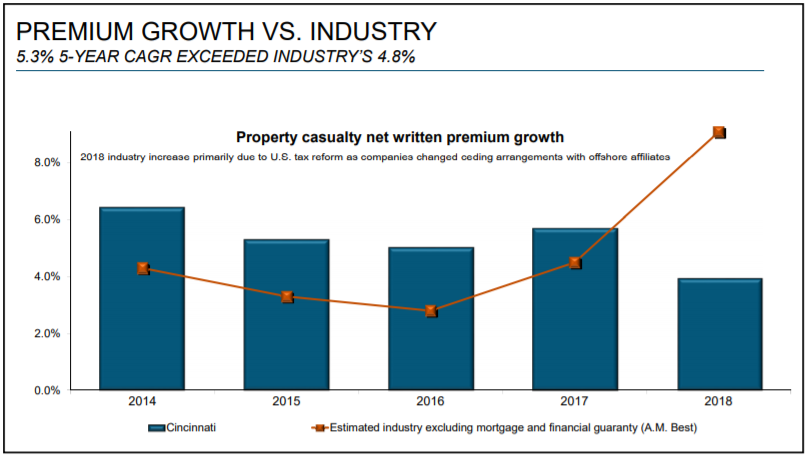

The company has grown its dividend for the last 38 consecutive years and is increasing its dividend by an average of 527 each year. Cincinnati financial stock price target raised to 135 from 120 at mkm partners oct. Declare date ex div record pay frequency amount. Expand research on cinf.

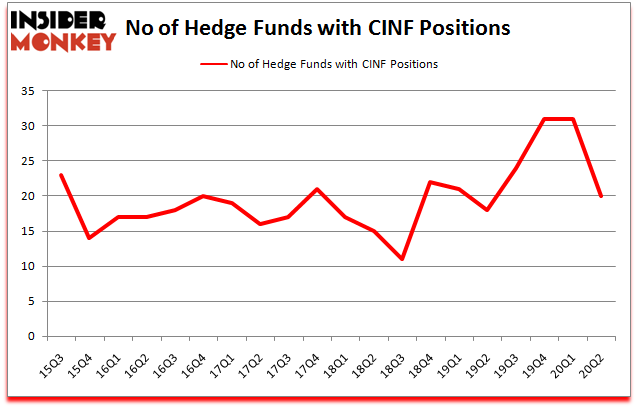

Cinfs most recent quarterly dividend payment was made to shareholders of record on thursday october 15. Gjensidige forsikring asa 19. 25 2019 at 939 am. Dividend history for cincinnati financial corp cinf ticker.

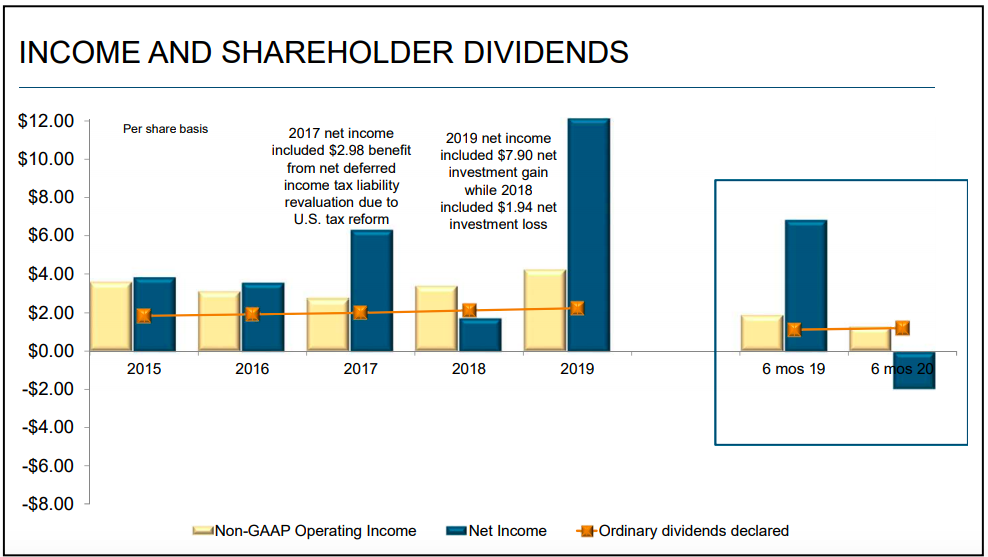

The long term stability of cincinnati financial is exemplified by its great history of paying out healthy dividends. In recent trading shares of cincinnati financial corp. The 212 per share regular cash dividend for 2018 represents the 58th consecutive year of increasing cash dividends to shareholders a streak we believe is matched by only seven other us. When a stock reaches.

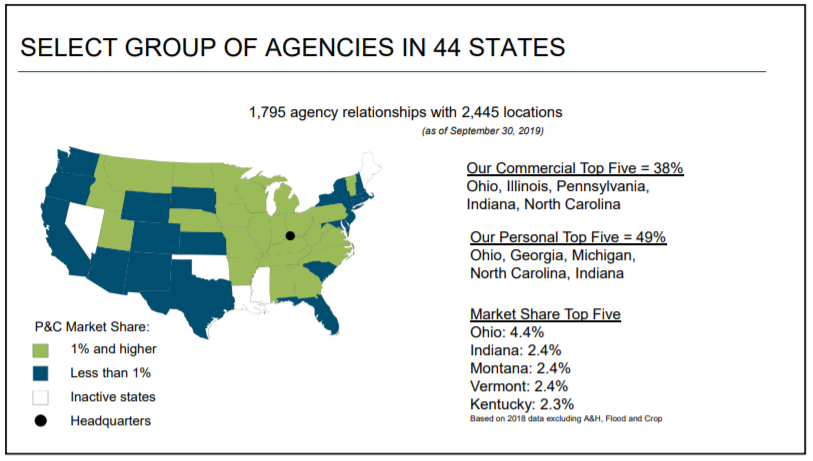

Et by tomi kilgore dozens of dividend aristocrat stock have been big winners in 2019. This fact enhances cincinnati financials appeal for many investors. First of all while mlps are similar to stocks theyre not exactly the same. Cincinnati financial was founded in 1950 and is headquartered in fairfield ohio.

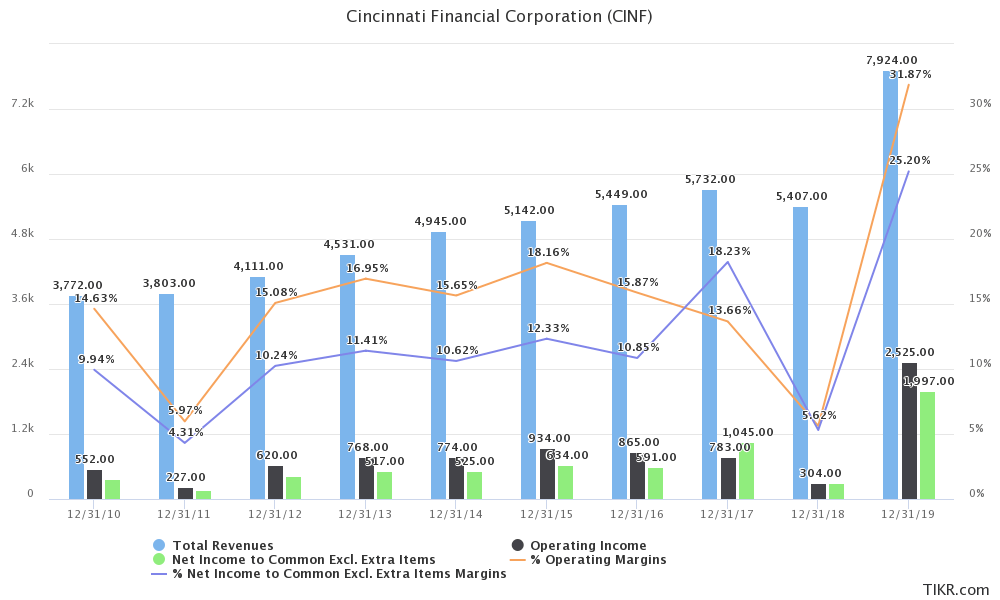

Cinf have crossed above the average analyst 12 month target price of 7567 changing hands for 8573share. Cincinnati financial corporation cinf dividend growth history. 7649 annualized dividend.